PDF CAPITAL BUDGETING PRACTICES OF MALAYSIAN COMPANIES Molly Chong

Content

This shows that the managers are not bothered that their credit rating may drop which affects their ability to get loans in the future at an acceptable rate and period. With a mean score of 3.45 for Transaction cost and fees Definition Of “capital Budgeting Practices” for incurring debt, it shows that managers are somewhat concerned with the consequences of incurring debt. Financial flexibility, with a mean score of 3.93, is the most important factor when determining the amount of debt.

- The survey revealed that around 46% of the participants use less than three techniques while the rest utilize more than three techniques.

- This criteria would result in many investments being rejected as the medium return on investment is not that high.

- To increase validity and to ensure its simplicity, understandability and the suitability of the respondents, the questionnaire was piloted to a group of investors in KSE who provided valuable suggestions to enhance participation.

- Capital budgeting decisions are influenced by certain factors dealing with economic, social, political, as well as cultural diversity2.

- Further, results also revealed that CFOs adjust their risk factor using discount rate.

The objective of the book is, to develop not only an understanding of the concepts of capital budgeting but also to help students to use it as an effective tool for communication, monitoring, analysis and resource allocation. It is hoped that it would provide a complete knowledge platform on capital budgeting and provide a direction to the academic and business fraternity to effectively cope with emerging financial issues and challenges enveloped with the topic. This paper compares the use of capital budgeting techniques of Dutch and Chinese firms, using data obtained from a survey among 250 Dutch and 300 Chinese companies. Our main aim is to analyse the use of capital budgeting techniques by companies in both countries from a comparative perspective to see whether economic development matters.

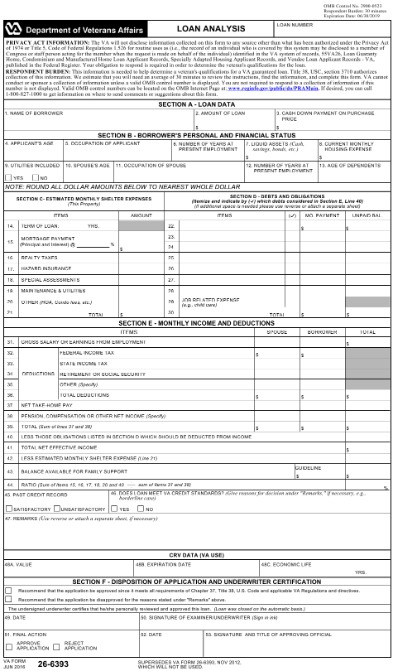

Table 9.

Capital budgeting is not a stand-alone single activity related decision; rather it is a process called the “capital budgeting process.” The nature of the capital budgeting process makes it extremely important in arriving at a capital investment decision. The capital budgeting process is a multifaceted activity designed to help in the selection of investment projects that are viable and worthy of pursuing. No all-around acknowledged agreement exists, and it is affected by many changing factors in the organizational environment. Mainly, capital budgeting process deals with planning, reviewing, analyzing, selecting, implementing and following up activities.

It was found that financial flexibility was a major factor in determining what level of debt the companies maintained. Other major factors included the volatility of earnings and cash flows, transaction cost for incurring debt and the potential cost of bankruptcy. It is hence not advisable to have such a high level of debt based on the above factors plus with the present economic climate, those factors would have a higher chance of occurring. More sophisticated techniques like the NPV and IRR are being utilized to aid them in the capital budgeting process.

Figures and Tables from this paper

The internal rate of return uses a simple form of analysis to determine the expected return of rate an investor can expect to earn on his investment. Because there is not a set formula used to calculate the internal rate of return, businesses commonly reach different conclusions when performing this analysis. Generally, if the internal rate of return exceeds the project’s minimum rate of return, the business will consider the project favorable.

It is also interesting to note that in the Australian manufacturing sector, 5 years is considered to be the adequate timeline for implementing any new strategy which could be another reason for the 5 year payback period. Respondents were found to be learned since they had considerable academic qualifications. The size of the capital budget was also identified from each respondent and tabulated as below. The companies within private and public sector differ in terms of size hence vary in annual capital budget.

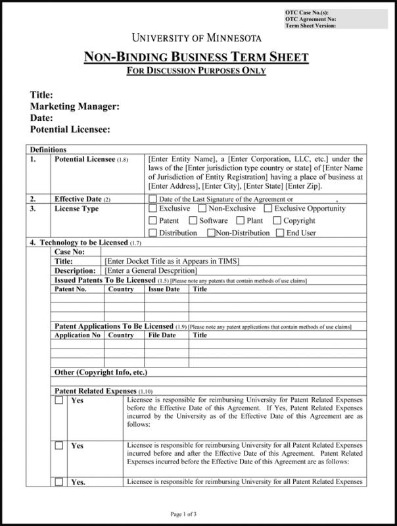

Definition of “Capital Budgeting Practices”

Of those, the majority of the Canadian firms used NPV and IRR, and only 8% preferred real options. The result shows a theory-practice gap remains in the detailed elements of DCF capital budgeting decision techniques and in real options. Capital budgeting is the process by which companies appraise investment decisions, in particular, by which capital resources are allocated to specific projects. It requires firms to give account for the time value of money and project risk using a variety of more or less formal techniques.

What is capital budgeting practices?

Capital budgeting involves identifying the cash in flows and cash out flows rather than accounting revenues and expenses flowing from the investment. For example, non-expense items like debt principal payments are included in capital budgeting because they are cash flow transactions.

This further established employee empowerment, negative effect of branch sales, comparison and application of standard budget for new companies within the SA chamber. This is because of the complexity of the techniques plus the fact that there are many variants and also that the techniques is flawed. This data shows that even though these companies are defined to be small by the ABS due to the fact that they have less than 100 employees, the principal decision making functions do not rest entirely on the shoulders of the owners or managers. Financial controllers and accountants have been employed to provide the owners with a better understanding of the consequences of their decisions in pursuing any particular project. Size of the capital budget has been categorized into five groups which are presented in Table 3.

Internal Rate of Return

Block noted that a number of patterns pertaining to capital budgeting were exhibited by small firms. Payback continued to be the dominant technique employed not due to lack of sophistication but rather the financial pressures placed on them by financial institutions. In spite of this, small business has become more sophisticated as over 27% used DCF as the primary method of analysis as compared to earlier studies.

It is hence recommended to integrate these risk analysis techniques into their capital budgeting process in light of the global economic and social instability. This shows that after correctly estimating the project and cash flows, capital budgeting techniques were to be applied to decide which projects maximised the wealth of the owners. Only 48% of the respondents used it frequently and 56.5% never even https://quick-bookkeeping.net/ used it at all. This may be due to the technique being not sophisticated enough plus the fact that it doesn’t provide a clear cut option for the financial controller to decide whether he/she should choose a particular project over others. The reason for this could be the increase of use of more sophisticated discounted cash flow techniques to compliment the Payback Period that they so regularly use.